Title: Enhancing Funds Flow by Factoring Invoices and Financing Purchase Orders

Title: Enhancing Funds Flow by Factoring Invoices and Financing Purchase Orders

You may get quick, easy, and cheap access to working cash with these loan options. Any type of business can benefit from invoice factoring and PO financing. They can help with the money needed for expansion, handling spikes in business, or even just covering the bills. And if your business is young and has no credit history, they are perfect for you.

The Basics of Factoring Invoices

It is simple to initiate and end invoice factoring. You must not have any outstanding claims or primary liens on your accounts receivable in order to be eligible. Additionally, you need reliable customers that pay their bills on time and in full.

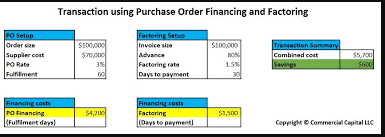

You can get fast cash advances, usually within 24 hours, when you factor in client bills. The total amount of the invoices you offer as security for your cash loan will be determined by their worth. As a general rule, factoring fees range from three to five percent of the invoice value, with the remaining amount due once the client pays the invoice. Invoices are typically valued at 80 percent upfront.

The factoring company receives payment straight from your consumers. When it comes to collecting their obligations, the factoring company is responsible for everything, including losses. You won't have to worry about making payments because invoice factoring isn't a loan. All you're doing is tapping into your clients' good credit to reinvest in your own firm.

Factoring has been around for a while and is a tried and true method of getting businesses the money they need when they ship, deliver, and invoice. Although the practice has been around since at least the time of the Roman Empire, the factoring industry in the United States is very young, having emerged just around 200 years ago in the early nineteenth century. The term "factor" refers to a business that has developed out of the role of American sales agents for European textile mills. Approximately 70% of conventional factor volume is still accounted for by the textile, garment, and associated industries, which place a high importance on credit guarantees, as reported by the Commercial Finance Association.

To take on new projects, fulfill big orders, and pay creditors on time or ahead of schedule, invoice factoring can supply your company with the working cash it needs. In a nutshell, factoring may help your company's cash flow remain steady while it expands. As a result, you may be able to put your financial concerns to rest and instead focus on increasing output and developing strategies for sustainable growth. You can save time and effort by using factoring to handle bad debts and accounts receivable.

Invoice factoring is significant for a number of different reasons (pardon the pun):

No application or setup fee is required.

- Which accounts will be funded is up to you.

- You have 30 days from the date of the invoice to make a qualifying claim.

It is not necessary to factor all bills or have a minimum amount of funding.

You will get the money deposited into your bank account immediately.

- For your convenience, customers can mail their checks to our lockbox.

Profiting from Advance Payment Financing

Manufacturers, importers, exporters, and distributors can benefit from PO financing by establishing immediate cash flow reserves. Clients that have already presold items to creditworthy end users might use this form of short-term financing to pay for their production or acquisition. A company can acquire the inventory necessary to fulfill customer orders by the issuance of letters of credit or the provision of monies.

An existing purchase order or the money from an upcoming purchase order serves as collateral for working capital financing through PO financing. Typically, when a lender takes control of inventory or raw materials, it perfects the security interest.

In order to free up capital for other essential company needs, PO financing might pay your supplier immediately for the cost of your goods. Timely client deliveries, growth without increasing bank debt or selling equity, and improved market share can all be achieved with this. You need to gather buyer and supplier details, company financials, and invoices from both parties in order to be eligible for PO Financing.

Although finished goods are typically easier to finance, PO financing is accessible for both finished and non-finished goods. The direct transfer of products from manufacturer to consumer is what defines finished goods transactions. In no way should you ever touch or physically possess them.

When you, the vendor, acquire raw materials (like blue denim yarn) or semi-finished products (like partially sewed blue jeans), these are considered non-finished commodities. The product must be physically transferred to you in any instance.

A number of problems with cash flow can be alleviated using purchase order financing. Consider the following: Buyers prefer net 30 to 60 days, whereas providers prefer cash on delivery (C.O.D.). Until you get payment for your invoices, you won't have any money coming in. This includes the time it takes for the goods to be made and shipped.

Your business might benefit from PO funding if...

- More working capital is required.

You do not possess the necessary expertise to manage the finances.

You have an urgent sales requirement that requires a prompt answer.

Adding domestic or international credit risk is something you want to avoid at all costs.

You would prefer that your sellers and buyers remain anonymous.

You are looking for a way to increase your profit margin.

Buyers and suppliers from the United States and throughout the world can utilize purchase orders. Imagine a supply and buyer from the United States: What you do is make clothes. You've got a solid six-year track record of profitability and a solid balance sheet. Your suppliers' credit has been exhausted, and you have recently received a sizable order. You make $75,000 while selling the goods to a customer for $100,000. The gross margin for your business is 25%. In exchange for factoring your receivables and a 5% purchase order fee ($5,000 x 5% of $100,000), the financing business will buy the products from your supplier and give you 45 days to manufacture them.

Post a Comment for " Title: Enhancing Funds Flow by Factoring Invoices and Financing Purchase Orders"